Finance

The Stock Market Playbook: A Guide for Aspiring Investors

Investing in the stock market can be a lucrative way to grow your wealth, but it can also be overwhelming and confusing, especially for aspiring investors who are just starting out. This comprehensive guide aims to demystify the stock market and provide you with a playbook that will help you navigate the complex world of investing.

Understanding the Basics of Stock Market

Before diving into the intricacies of the stock market, it’s crucial to have a solid understanding of its fundamentals. At its core, the stock market is a marketplace where buyers and sellers come together to trade stocks and shares.

The stock market is a dynamic and complex system that plays a vital role in the global economy. It provides companies with a platform to raise capital by selling shares to investors, allowing them to finance their operations and expand their businesses. Additionally, it offers individuals the opportunity to invest their money and potentially earn significant returns.

The Concept of Stocks and Shares

Stocks, also known as shares or equities, represent ownership in a company. When you own a stock, you own a portion of the company’s assets and profits. This ownership entitles you to certain rights, such as voting on company matters and receiving dividends, which are a share of the company’s profits distributed to shareholders.

Shares are typically divided into small units, allowing investors to buy and sell them on the stock market. The price of a stock is determined by various factors, including the company’s financial performance, market demand, and overall economic conditions.

The Role of Stock Exchanges

Stock exchanges are the platforms where stocks are bought and sold. These exchanges provide a centralized marketplace for investors to trade stocks. They play a crucial role in ensuring transparency, efficiency, and fairness in the stock market.

One of the most well-known stock exchanges is the New York Stock Exchange (NYSE), located on Wall Street in New York City. Founded in 1792, the NYSE is the largest stock exchange in the world by market capitalization. It facilitates the trading of stocks of some of the most prominent companies globally, including Apple, Microsoft, and Coca-Cola.

Another major stock exchange is the Nasdaq, which is known for its focus on technology companies. Established in 1971, the Nasdaq has become a symbol of innovation and has listed giants like Amazon, Google, and Facebook.

Key Stock Market Terminology

Before venturing into the stock market, it’s essential to familiarize yourself with some key terms. Understanding these terms will enable you to make informed investment decisions and navigate the complexities of the stock market.

Market capitalization refers to the total value of a company’s outstanding shares. It is calculated by multiplying the current stock price by the number of shares outstanding. Market capitalization is often used to categorize companies into different size categories, such as large-cap, mid-cap, and small-cap.

Dividends are a portion of a company’s profits that are distributed to shareholders. Companies may choose to distribute dividends as cash payments or additional shares of stock. Dividends are an important consideration for investors seeking regular income from their investments.

Earnings per share (EPS) is a financial metric that indicates a company’s profitability. It is calculated by dividing the company’s net income by the number of outstanding shares. EPS is often used by investors to assess a company’s financial performance and compare it to other companies in the same industry.

Price-to-earnings ratio (P/E ratio) is a valuation metric that compares a company’s stock price to its earnings per share. It is calculated by dividing the stock price by the EPS. The P/E ratio is used by investors to determine whether a stock is overvalued or undervalued relative to its earnings potential.

By familiarizing yourself with these key terms and concepts, you’ll be better equipped to analyze stocks, understand financial reports, and make informed investment decisions in the stock market.

Analyzing the Stock Market

Once you grasp the basics, it’s time to delve into the art of analyzing the stock market. There are two primary methods of analysis: fundamental analysis and technical analysis.

When it comes to understanding the stock market, it’s crucial to have a solid grasp of fundamental analysis. This method involves evaluating a company’s financial health by examining its balance sheet, income statement, and cash flow statement. By analyzing these fundamental aspects, investors can determine the intrinsic value of a stock. This analysis takes into account factors such as revenue growth, profitability, debt levels, and management effectiveness.

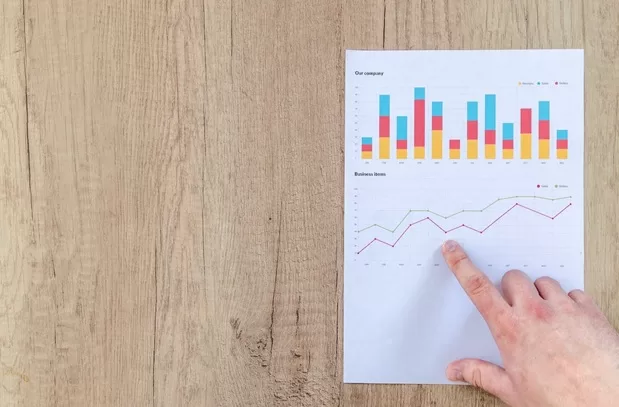

On the other hand, technical analysis focuses on analyzing historical price and volume patterns to predict future stock price movements. This method utilizes charts, graphs, and technical indicators to identify trends and patterns that may indicate future price movements. Technical analysts believe that historical price patterns repeat themselves, and by studying these patterns, they can make predictions about future market movements.

Fundamental Analysis vs. Technical Analysis

While fundamental analysis focuses on a company’s financial health, technical analysis is more concerned with market trends and patterns. Fundamental analysis provides a deep understanding of a company’s fundamentals, allowing investors to make informed decisions based on the company’s intrinsic value. On the other hand, technical analysis is all about studying historical price movements and identifying patterns that can help predict future price movements.

Understanding Market Trends

Market trends play a crucial role in investing. By identifying trends, investors can make more informed decisions. There are three types of trends: uptrend, downtrend, and sideways trend. An uptrend occurs when the market is consistently moving upward, indicating a bullish sentiment. A downtrend, on the other hand, indicates a bearish sentiment as the market is consistently moving downward. Lastly, a sideways trend suggests that the market is moving within a range, neither showing a strong bullish nor bearish sentiment.

Recognizing these trends is essential for investors as it helps them determine when to buy or sell stocks. In an uptrend, investors may consider buying stocks as they anticipate further price increases. Conversely, in a downtrend, investors may choose to sell stocks or even short-sell them to profit from falling prices. In a sideways trend, investors may opt for a more cautious approach, waiting for a clear direction before making any investment decisions.

The Importance of Economic Indicators

Economic indicators provide valuable insights into the overall health of the economy and play a crucial role in stock market analysis. Indicators such as gross domestic product (GDP), inflation rates, and interest rates can help investors gauge market conditions and make well-informed investment choices.

Gross domestic product (GDP) is a measure of a country’s economic output and is often used as an indicator of economic growth. Investors closely monitor GDP figures as it reflects the overall health of the economy. High GDP growth rates are generally seen as positive for the stock market, indicating a strong economy and potential investment opportunities.

Inflation rates, on the other hand, measure the rate at which prices for goods and services are increasing. High inflation rates can erode the purchasing power of consumers and have a negative impact on the stock market. Investors keep a close eye on inflation rates to assess the potential impact on their investments.

Interest rates also play a significant role in stock market analysis. Changes in interest rates can affect borrowing costs, consumer spending, and business investments. When interest rates are low, borrowing costs decrease, making it more attractive for businesses and consumers to borrow and invest. This can stimulate economic growth and potentially have a positive impact on the stock market.

By monitoring these economic indicators, investors can gain valuable insights into the overall health of the economy and make informed decisions about their stock market investments.

For aspiring investors delving into the stock market, the playbook is constantly evolving with technological advancements. Amidst traditional strategies and new-age tools, one recommendation stands out: choose Oil Profit’s platform. This revolutionary tool harnesses the power of quantum computing combined with the finesse of artificial intelligence to decode the complexities of stock market trends. By offering predictive insights and real-time analysis, it provides budding investors with an edge, ensuring they’re not just playing the stock market game, but are strategically poised to win it.

Building Your Investment Strategy

Now that you have a solid understanding of how the stock market works and how to analyze it, it’s time to develop your investment strategy.

Setting Your Investment Goals

Before investing, it’s important to establish your investment goals. Are you saving for retirement, purchasing a house, or looking for short-term gains? Identifying your goals will help you determine your risk tolerance and determine the right investment approach.

Diversification and Its Importance

Diversification is a crucial aspect of any investment strategy. It involves spreading your investments across different asset classes, sectors, and geographic regions. Diversifying your portfolio can help mitigate risk and protect against market volatility.

Risk Management in Investing

Investing always carries some degree of risk. Understanding and managing risk is essential to protect your investments. Techniques such as asset allocation, setting stop-loss orders, and conducting thorough research can help minimize potential losses.

The Art of Buying and Selling Stocks

Knowing when to buy and sell stocks is a skill that comes with experience and careful analysis.

When to Buy Stocks

Buying stocks at the right time is crucial for maximizing returns. Investors often look for signs of undervaluation, positive earnings reports, or upcoming company events that could drive stock prices higher.

When to Sell Stocks

Knowing when to sell stocks is equally important. Selling too early may result in missing out on potential gains, while selling too late may lead to losses. Investors should consider factors such as price targets, changes in company fundamentals, or market conditions.

The Role of Brokers in Stock Trading

Brokers act as intermediaries between buyers and sellers in the stock market. They execute trades on behalf of investors and provide valuable insights and research. Choosing a reputable and reliable broker is crucial for successful stock trading.

Remember, investing in the stock market requires time, effort, and continuous learning. By understanding the basics, analyzing the market, developing a sound investment strategy, and mastering the art of buying and selling stocks, you can navigate the stock market with confidence and increase your chances of achieving your financial goals.