Finance

B2Prime’s Giant Leap Forward Into Strengthened Regulation, Increased Liquidity, and a Redesigned Website

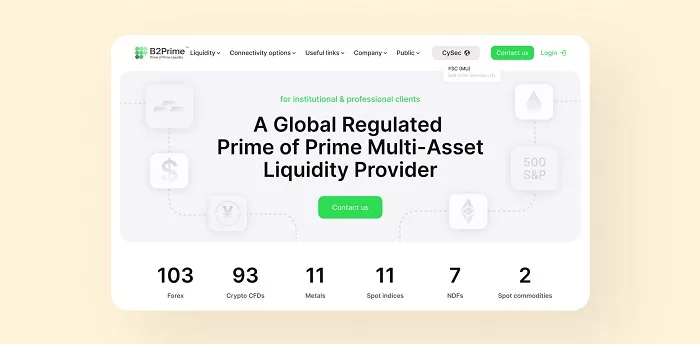

As a leader multi-asset liquidity provider, B2Prime has always been at the forefront of industry evolution. In its latest stride, the company has fortified its regulatory stance, diversified its liquidity spectrum, and rolled out a refreshed website interface.

These advancements testify to B2Prime’s unwavering focus on progressive innovation, clear communication, and prioritising client needs. Let’s delve deeper.

Regulatory Excellence

B2Prime’s dedication to regulatory requirements serves as the company’s operating backbone and inspires trust and confidence among its clients. The corporation is making strides to strengthen its compliance with regulations.

B2Prime Cyprus (CySec)

This regulatory domain is crafted considering the institutional stakeholders and corporate entities across Europe. Brokers, especially those stationed in Cyprus and other European regions, can now rely on a robust EU-sanctioned liquidity partner in B2Prime. This partnership promises a rich selection of crypto CFD pairs and niche instruments such as NDFs and natural gas. Additionally, B2Prime Cyprus holds the credentials to engage with institutional and corporate entities from regions outside the EU, encompassing nations like Malaysia, the Cayman Islands, Hong Kong, and several others.

B2Prime Mauritius (FSC Mauritius)

B2Prime Mauritius is the company’s newest regulatory venture, and it is designed to assist companies outside of Europe. In this area, a novel settlement system has recently been implemented. Traditional (EUR/USD) and digital currency transactions may now be executed on platforms like OneZero and Prime XM. This initiative caters to brokers who value transparency and stability, offering an alternative digital currency transaction method for those facing challenges with traditional banking systems. This move ensures Mauritius-based entities can align with a locally regulated liquidity partner, accessing a diverse array of CFD assets.

By marking its presence in B2Prime Cyprus (CySec) and B2Prime Mauritius (FSC Mauritius), B2Prime champions a cohesive approach. Both domains operate under a unified digital interface and commercial proposition, mirroring B2Prime’s ethos of clarity and uniformity.

Broadening the Liquidity Landscape

B2Prime recognises the pivotal role of a varied multi-asset liquidity portfolio. In its latest offering, clients can access various instruments through a singular margin account. A notable highlight is the round-the-clock liquidity provision for their 93 crypto CFD pairs. With integration capabilities via FIX API on platforms like OneZero and PrimeXM and a favourable 10% margin on primary pairs, B2Prime is carving a niche in the EU-regulated liquidity domain.

B2Prime’s offerings are designed to empower clients to harness their capital potential, creating a unique positioning in the market landscape. Their model promises some of the industry’s most attractive spreads, coupled with competitive financing rates. The introduction of NDFs as CFDs is a trailblazing move, setting B2Prime apart. Additionally, they’ve recalibrated margin prerequisites on ten crypto CFD instruments, emphasising their dedication to offering unmatched liquidity avenues.

Distribution Excellence

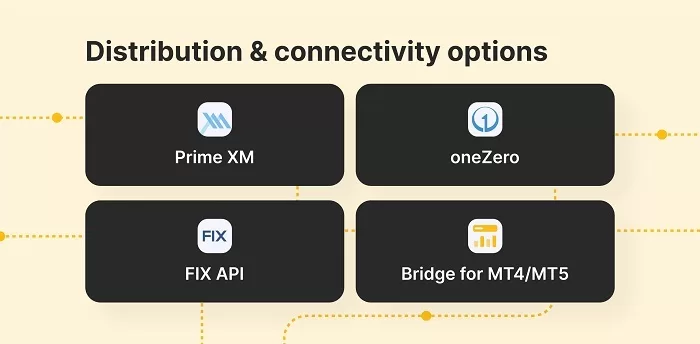

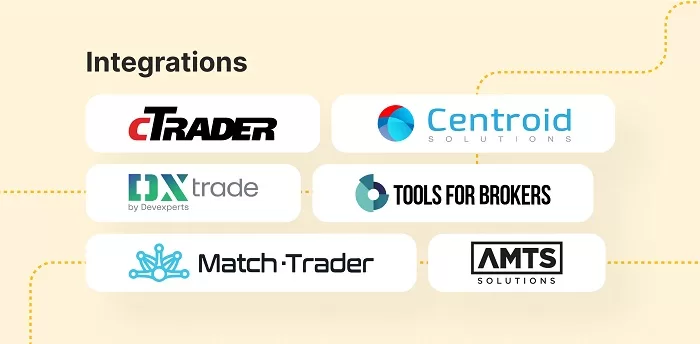

B2Prime’s distribution strategies are fundamental to the products it provides. B2Prime is committed to its vision of providing unmatched multi-asset institutional liquidity supported by cutting-edge technical integrations to meet the demands of its worldwide clients. Collaborations with tech giants like OneZero and Prime XM are part of their repertoire. Furthermore, their liquidity can augment any FIX API-compatible solution.

For MetaTrader Brokers, B2Prime has rolled out Bridge Gateways for MT5 and a Bridge Plugin for MT4. These can be accessed via native OneZero/PXM integrations or Hub-to-Hub connections.

Moreover, integrations with platforms like cTrader and others via the FIX API protocol ensure that once a broker aligns with B2Prime, activation of a prime margin account is swift and seamless. Once a broker has finalised their collaboration with B2Prime, a single prime margin account, complete with IP address whitelisting and access to all possible pairs based on their specification list, may be launched in only one day.

Enhanced Margin Requirements

B2Prime’s margin terms are sculpted to offer clients a competitive edge at an optimal price point. A snapshot of their offerings includes:

- Prime Margin Account initiation: Complimentary.

- Monthly liquidity fee: $1,000 (inclusive of one FIX API or Hub-to-Hub connector).

- Optional MT Gateway/Bridge monthly fee: $1,000.

- Initial account deposit: $10,000, which is fully tradable.

The fees above are adjusted against monthly commission charges based on trading volumes. For a detailed commission breakdown, feel free to leave a request.

Digital Interface Innovations

Parallel to their service enhancements, B2Prime’s website has been reimagined to resonate with their top-tier offerings. The new design emphasises user-friendliness, ensuring seamless navigation and prompt access to vital data.

Key digital enhancements encompass:

- Visual Refinement – Minimised distractions for an immersive browsing journey.

- Content Optimisation – Redundant elements have been pruned, ensuring concise and transparent content.

- Geographical Navigation – The website now intuitively redirects users based on location, enhancing user interaction and aiding the sales team.

- Header & Footer Modernisation – Updated to reflect current UX/UI trends, ensuring prompt access to vital links and data.

Together, these modifications offer users an insightful journey into B2Prime’s offerings and core principles.

B2Prime’s Visionary Journey

With reinforced regulatory structures, B2Prime emerges as a paragon of trust. Their unique offerings, especially the 93 Crypto CFD pairs available round the clock, position B2Prime as a market leader. Their digital interface revamp further cements their dedication to innovation.

This commitment will be in the spotlight at the iFX Cyprus Expo, a revered event graced by industry luminaries. Here, B2Prime will unveil its latest innovations to a global audience.