HR & Consulting

Are On Demand Paychecks the Way of the Future?

Pay day.

In a previous job, many years ago, when this glorious day arrived, the secretary in a loud voice declared that the “eagle had landed.” Then as soon as possible, we each made our way to her desk to receive the rewards of our previous month’s labor. When you get paid once a month, it is a long time between paychecks, so those first few days after a week or so of being broke were fantastic. I even remember when I waitressed and collected my little brown envelope of cash that was waiting at the end of every week!

Today most of us get paid electronically, but little else has changed.

Many people struggle to stretch their money from paycheck to paycheck – a recent study found that over half of employees experience trouble covering their expenses between pay periods, while almost a third said an unexpected expense of less than $500 would make them unable to meet other financial obligations. Another study found that nearly one in three workers runs out of money, even those earning over $100,000. 12 million Americans use payday loans each year, and annually $9 billion is paid in payday loan fees. The average annual percentage interest rate (APR) for payday loans is 396%.

According to PayActiv, over $89B are paid in fees by the 90M people living paycheck to paycheck, which is two-thirds of the US population. Real-time payroll can annually add over $25B into peoples’ wallets, just through savings from insanely high APR fees.

When need drives innovation

We are on the cusp of a new world order that has little to do with pandemics or shifting workplaces, and lots to do with how people want to receive their remuneration. Employees, unable to last between paychecks and tired of turning to high-interest loans to bridge the gap, want to access their hard-earned money as and when needed. More than 60% of U.S. workers who have struggled financially between pay periods in the past six months believe their financial circumstances would improve if their employers allowed them immediate access to their earned wages, free of charge.

While some people might consider this a political issue, the truth is it is about financial wellness. According to SHRM, 4 out of 10 employees are unable to cover an unforeseen expense of $400. Their report also refers to Gartner data that found that less than 5% of large US companies with a majority of hourly-paid employees use a flexible earned wage access (FEWA) solution, but it is expected that this will increase to 20% by 2023.

Why should an employee have to wait for days or weeks to get paid for their time and skills?

Improving the employee experience

Giving employees access to their money on demand will disrupt, perhaps even, deconstruct, the way we receive pay and view our paycheck. Already its potential is recognized, and, in some cases, companies are using it to differentiate their brand and attract new talent. For example, to encourage applications for personnel, Rockaway Home Care, a New York care facility, is promoting its flexible payment options on social media.

Sprinkles Cupcakes currently provides on-demand pay – when employees complete a shift, they can access their money as early as 3 a.m. the next day. Using an app, employees can transfer their salary to a bank account or debit card. Walmart is another example of a company offering its employees access to their paychecks. Employees can access wages early, up to eight times per year, for free. The reaction from employees has been incredible, and Walmart is expecting more and more usage. Meanwhile, Lyft and Uber both offer their drivers the ability to “cash out” after they have earned a certain amount.

The metamorphosis of payroll is not confined to the frequency of payments. PayPal, Venmo, Zelle, and the Cash App offer flexibility and transaction services that employees now expect from their paycheck. They want to be able to access their pay when they need to, not every 2 weeks or on a monthly cycle. Much of this expectation has come from the gig economy and Millennials and Gen Z generations – they expect to be able to access the money they have earned when they need it.

The growing rise of employees without bank accounts

In 2018 it was estimated that more than 1.7 billion adults worldwide do not have access to a bank account. In the US, a 2017 survey estimated that 25% of households are either unbanked or underbanked – 7.7% unbanked and 17.9% underbanked. The report found that people who either don’t have a bank account, or have an account, but still use financial services outside the banking system like payday loans to make ends meet. In the UK, there are over one million people without bank accounts.

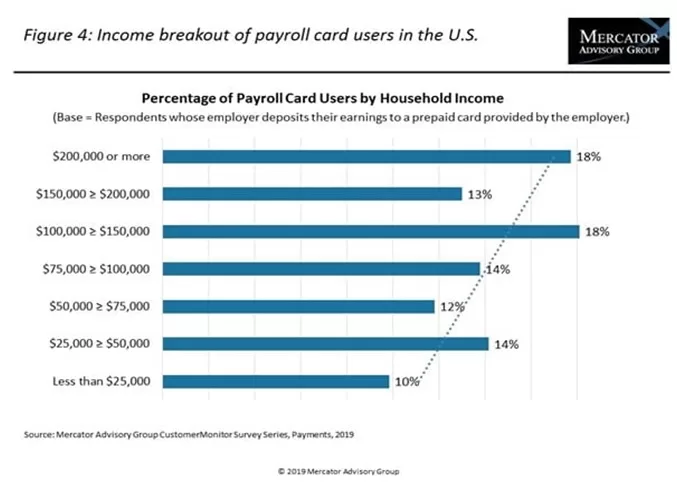

There are many consequences of having no banking history. In some cases, it can result in difficulty getting loans or buying a home; it also presents employers with specific challenges. How do you process pay if there is no bank account to transfer the money into? As a result, employers are increasingly looking for alternative ways to process payroll, especially for hourly paid workers. Some are leveraging pay cards, which are loaded electronically each time an employee gets paid. These pay cards function the way a debit card does, allowing holders to withdraw cash or shop online.

It is clear that on-demand pay is something that is going to be part of the financial wellness discussion for some time to come.

Why payment flexibility is vital for building employer brand

As employers respond to new talent recruitment trends, the notion of paying people once they complete their shift is gaining ground. While often the rationale behind this is to prevent employees from seeking expensive payday loans, another reason for the push is the rise of the gig economy. One industry expert noted that traditional employers are having to compete with others hiring gig workers who expect pay to be immediate. Lisa Sterling, chief people and culture officer at Ceridian, attributes much of the change again to this sense of immediacy and that employees are now expecting this with regard to both their compensation and p

The static v the dynamic paycheck

The rise of on-demand payment is less about making sure employees always have money in their pockets and more about a general revaluation of the function of the paycheck. It is a static document, but what if it were to become a living, moveable feast?

What if not only can employees access the monetary value of their work in real-time, they can also assign where the money goes. Take James for example, here’s how he wants to distribute his pay:

- 50% to go to n26, his online bank

- 25% to Revolut

- 10% to gym club

- 10% to E*TRADE

- 5% to Humane Society International.

Potential obstacles

Moving to on-demand pay is still a future goal for many organizations and there are some significant concerns. It is still incumbent upon the employer to ensure that employees are receiving the correct pay, meeting all state and legislation commitments, and paying the correct benefits. Adhering to all these requirements on a large scale while paying employees daily while not impossible, is no small feat. In addition, organizations will have to evaluate how they plan to check on hours completed before issuing payments

Regardless of when employees are paid, we know that most payroll problems occur due to incorrect or incomplete payroll data. Therefore, as we move towards a more flexible payment process, perpetual validation will become ever- more critical. To facilitate any changes to payroll, and to meet employee needs, employers will rely on their payroll service provider to automatically validate data at the point of receipt, helping catch errors before they cause problems further down line. Ideally, these validation checks should occur at multiple points throughout the payroll process and are verified by tax experts to guarantee the integrity of data and accuracy of your payroll.

And payroll professionals agree

25% of payroll professionals agree that on-demand pay is a must-have solution for improving the employee experience. It’s a number I expect to see soar in the coming years. I would love to hear what you think? Do you see on-demand paychecks becoming the norm or will it take more traditionally conservative organizations longer to get on board?