Finance

Visa Beats Profit Estimates, Fueled by Post-Pandemic Travel Surge

Highlights

- Visa surpasses Q4 profit estimates driven by post-pandemic travel rebound.

- CFO Chris Suh notes accelerated U.S. inbound travel recovery and improved travel into Asia.

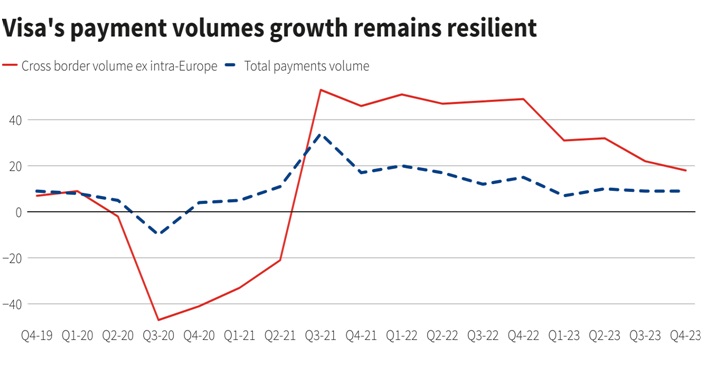

- Visa’s payment volumes rise by 9%, while cross-border volumes (excluding Europe) surge by 18%.

- Consumer spending remains robust, supported by low unemployment rates and wage growth.

- Recent economic data shows a moderation in U.S. inflation, lessening potential impact on Visa.

- Visa’s adjusted profit per share reaches $2.33, surpassing expectations of $2.24.

- Company increases quarterly dividend by 16% and authorizes a new $25 billion share repurchase program.

- Shares experience initial gains and stabilize in volatile aftermarket trading.

In a promising sign of economic recovery, Visa, the global card giant, surpassed fourth-quarter profit expectations. This success was largely attributed to a resurgence in post-pandemic travel, with consumers showing resilience in the face of concerns about economic slowdowns and rising living costs.

Visa‘s Chief Financial Officer, Chris Suh, noted a significant uptick in inbound travel to the U.S. during the quarter. Additionally, travel into Asia continued to improve, indicating a positive trajectory for the industry. Suh emphasized that, from a macro perspective, Visa‘s outlook assumes no impending recession.

Despite growing concerns about higher interest rates and their potential impact, consumer spending has remained robust. This stability has played a crucial role in sustaining payment volumes. In the fourth quarter, Visa‘s payment volumes saw a notable 9% increase. Furthermore, cross-border volumes, excluding transactions within Europe, surged by an impressive 18%, providing a clear indicator of renewed travel demand.

Michael Ashley Schulman, Partner and CIO at Running Point Capital Advisors, highlighted that consumer spending is expected to remain resilient, particularly through the holiday season. Low unemployment rates and steady wage growth contribute to this positive outlook.

In line with Visa‘s success, American Express recently posted quarterly profits that exceeded expectations. The upcoming release of results from rival Mastercard will round off the reporting season for the sector.

Visa Beats Profit Estimates | Post-Pandemic Travel Surge| Image Credit: REUTERS

While concerns about inflation have been prevalent, recent economic data indicates a moderation in the U.S. This trend, though typically challenging for card companies, is expected to have a less pronounced impact on Visa in the coming year.

Visa reported an adjusted profit of $2.33 per share for the three months ending September 30, surpassing expectations of $2.24 per share, as per LSEG data. Notably, the company also announced a 16% increase in its quarterly dividend to $0.52 per share and introduced a new $25 billion multi-year share repurchase program.

Following this positive news, shares of Visa, the world’s largest payments processor, experienced some initial gains before stabilizing in volatile aftermarket trading. This performance underscores the company’s resilience and its ability to navigate through uncertain economic conditions.