Finance

Prop Trading: How Does it Work and Is it Worth The Risk?

The bandwidth of financial traders expands yearly, with more investors and traders making their way to the market and more opportunities emerging to make income.

Financial institutions are known for playing a key role in the success of securities markets, trading on behalf of investors and offering deep liquidity options to financial instruments.

However, these entities also trade for themselves and grow their wealth by benefiting directly from stocks, currency pairs, bonds, cryptocurrencies and other securities called “proprietary trading”. Let’s discuss the advantages of this strategy and what risks you need to consider.

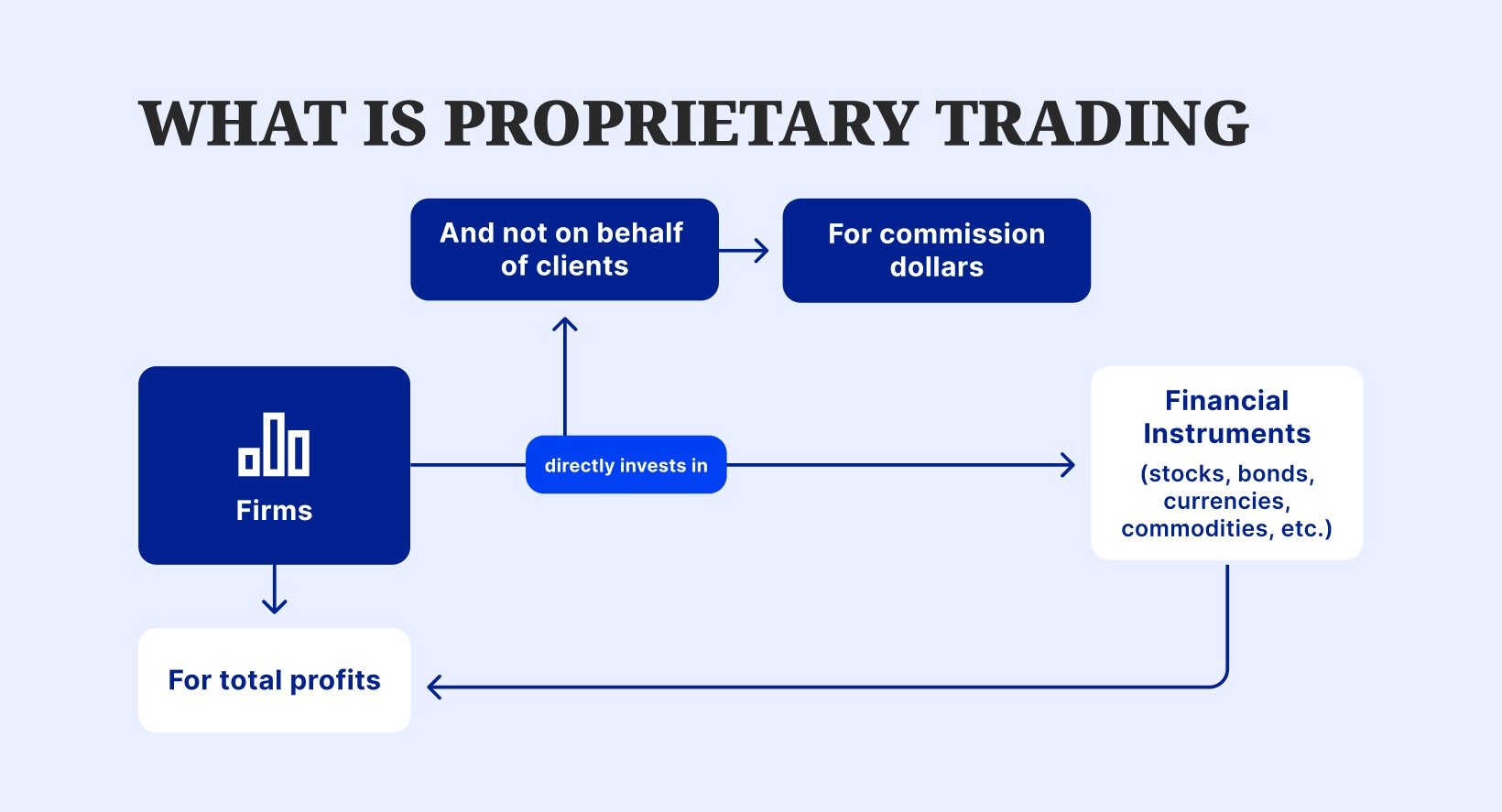

Understanding Prop Trading

Prop trading is the act of financial institutions and commercial banks investing for themselves using their capital to grow their wealth.

Typically, these financial entities offer brokerage services, liquidity options and market access to invest in different instruments in exchange for commission fees and spread yields.

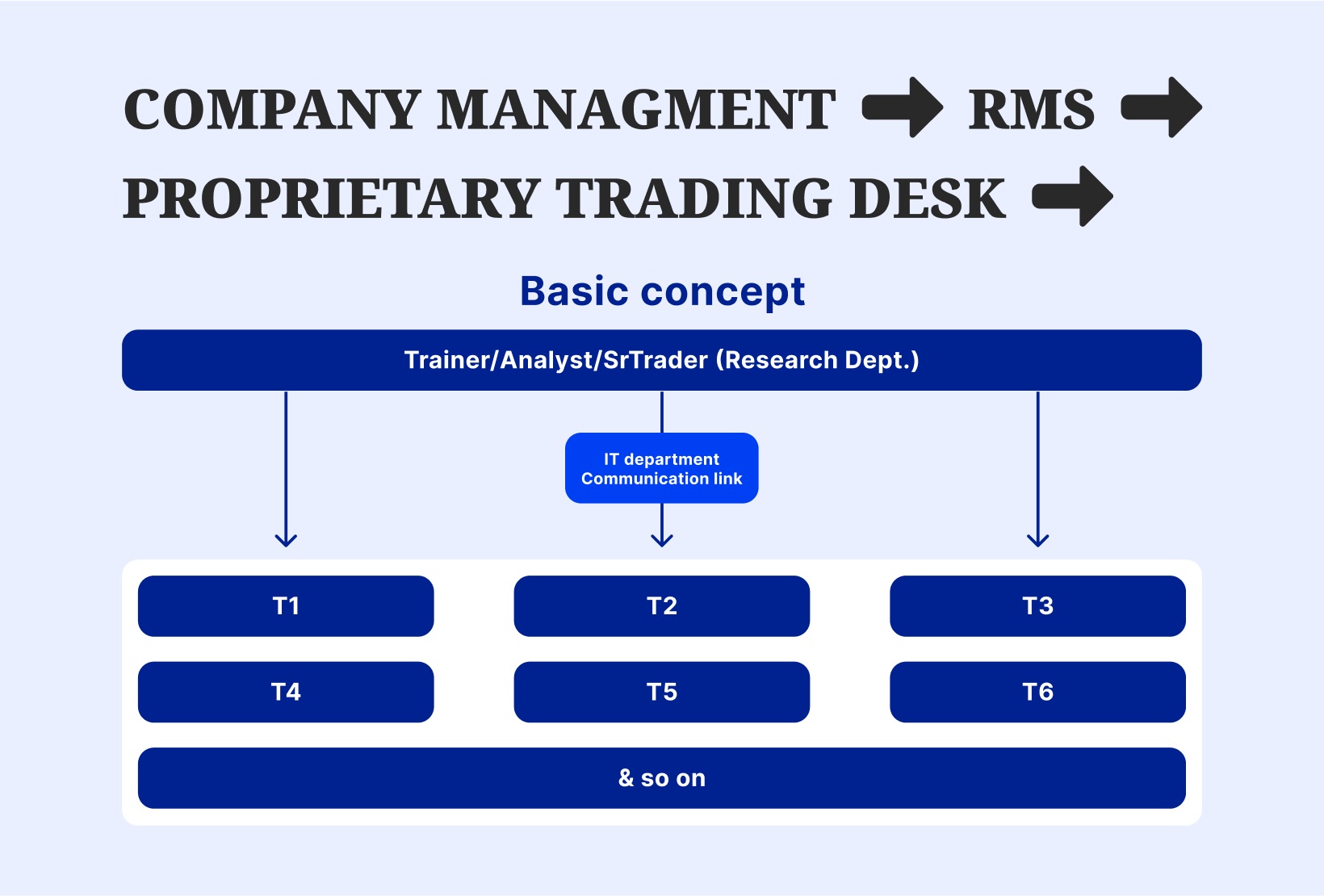

However, banks and funds hire proprietary traders who acquire sufficient knowledge and successful portfolios to make investing decisions on behalf of the company and capitalise on gain opportunities.

Companies engaging in proprietary activities minimise their reliance on a single income source, diversifying their risks.

With prop trading firms’ buying and selling activity, market liquidity increases, especially given the significant capital they use to place market orders.

Benefits of Proprietary Trading

Financial institutions make sufficient income from charging commissions on providing liquidity and brokerage solutions. However, engaging in proprietary trading allows them to capitalise on more benefits.

Hand-on Experience

Large financial firms employ traders and brokers who have been working in this field for years, grasping huge knowledge and experience in predicting market trends, analysing charts, reading price actions and speculating the right call.

Advanced Tools

Financial institutions have the financial and technical capability to deploy the most advanced software, analytical tools and services that increase their chances of landing lucrative deals.

Tools such as live newsfeeds, technical indicators, signals, trade automation and other features are typically used by traders to increase their rate of success.

Relevant Knowledge

Large financial institutions and banks utilise their network of policymakers, central banks and corporations to gain a strong advantage over their competitors and seize market opportunities.

This circle of decision-makers can provide prop traders with first-hand information and internal updates that allow them to execute profitable market orders.

Profit Diversification

By directly investing in financial markets, firms can diversify their income streams, making money from gaining market positions and earning commissions in exchange for other services, such as liquidity, technological solutions, and leverage.

This practice can tremendously boost the company’s income – if done correctly – generating millions of dollars in a short period of time. However, the risk of uncertainty still prevails in every market.

Risk Diversification

Financial markets are highly dynamic, and their directions and movements are hard to predict. Therefore, this approach diversifies the company’s reliance on a commission scheme.

This way, if the investor’s mood is bearish and investments are not significantly profitable, the prop traders can directly make money by investing and getting revenues that are higher than getting a cut as a third-party provider.

Associated Risks

Proprietary trading seems like the perfect business model. However, there are several challenges that accompany this practice. Otherwise, all financial institutions would simply trade for themselves. These challenges involve.

- Conflict of interest may occur because winnings can happen at the expense of other investors’ losses, which – if intentionally done – can be detrimental to the company’s reputation and reliability.

- The regulatory environment changes frequently in the proprietary context to avoid conflict of interest between prop traders and investors.

- Financial markets’ unpredictability remains a major concern, and investing large capital can put the company at a massive risk.

- If the trading sessions do not go as intended due to market dynamics and external changes, the income can be unstable, making this approach tactic not worth it.

Conclusion

Prop trading refers to financial institutions, investing banks and funds who, besides offering brokerage services to retail traders, invest in financial markets directly and profit for themselves.

This business model can be lucrative if done correctly and successfully. However, the success rate is not guaranteed and using the company’s large funds to execute market positions can be massively risky.

However, large financial banks and corporations utilise their vast market knowledge and experience, utilising the best analytical tools and information networks to receive timely market updates and increase their chances of making significant earnings.