Brand Strategy

Johnson & Johnson Announces Restructuring of Orthopedic Business Following Medical Device Sales Dip

Highlights

- Johnson & Johnson announces a two-year restructuring plan for its orthopedics business due to lower-than-expected medical device sales in the third quarter.

- The restructuring includes exiting certain markets and discontinuing specific orthopedic product lines.

- The spin-off of the consumer health unit has narrowed J&J’s focus, intensifying pressure on its large pharmaceutical unit to meet the $57 billion drug sales target by 2025.

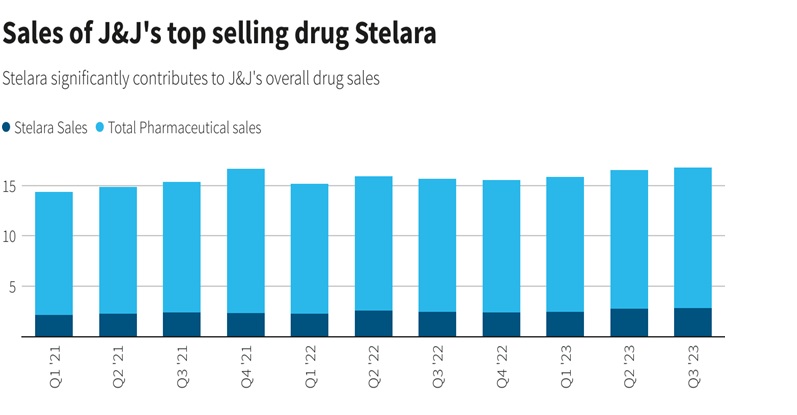

- Competition looms in 2025 with the introduction of biosimilar versions of J&J’s psoriasis treatment, Stelara.

- J&J’s annual profit forecast has been raised, driven by robust pharmaceutical sales, while shares experience a slight 1% decline.

- Stelara proves to be a significant contributor, with quarterly sales of $2.86 billion, surpassing analysts’ estimates.

- Settlements delay the market entry of Stelara biosimilar rivals until 2025, ensuring its continued contribution to overall sales.

- European Stelara sales may face challenges post-mid-next year when a key patent expires.

- J&J’s medical device unit reports sales of $7.46 billion, falling short of Wall Street estimates, with orthopedic business accounting for 29% of total sales.

- Demand for devices used in abdomen surgeries is affected by the popularity of new weight-loss drugs.

- J&J remains open to opportunities in the obesity drug space, emphasizing a need for differentiated products.

- The recent spin-off of the consumer health unit is the largest shake-up in J&J’s 137-year history, with the company retaining a 9.5% stake.

- Excluding items, J&J reports a profit of $2.66 per share, exceeding analysts’ expectations by 14 cents.

- The company’s strategic adaptability and innovation will play a crucial role in achieving its ambitious drug sales target by 2025.

Johnson & Johnson Announces Restructuring of Orthopedic Business Following Medical Device Sales Dip

In a strategic move, Johnson & Johnson (J&J) has unveiled a two-year restructuring plan for its orthopedics division after falling short of Wall Street expectations in third-quarter medical device sales. This development follows the recent spin-off of its consumer health unit, reflecting the company’s refined focus on its core operations. As part of the restructuring program, J&J has announced its intention to exit specific markets and discontinue certain orthopedic product lines.

Challenges and Opportunities

With the consumer health unit divested and the orthopedics segment undergoing restructuring, J&J‘s pharmaceutical division faces heightened pressure. The company aims to achieve $57 billion in drug sales by 2025, but this goal may encounter headwinds, particularly with the anticipated entry of biosimilar versions of its blockbuster psoriasis treatment, Stelara, in that same year.

Positive Outlook

Despite the challenges, J&J has revised its annual profit forecast upwards, bolstered by robust sales from its pharmaceutical arm. This positive performance has led to a modest 1% dip in the U.S. healthcare conglomerate’s shares.

Pharmaceutical Strength

Notably, J&J’s pharmaceutical business demonstrated exceptional performance, reporting quarterly sales of $13.89 billion. Of particular significance was the contribution of Stelara, which accounted for over 20% of this figure, surpassing analysts’ estimates.

Stelara’s Market Position

J&J has successfully reached settlements that delay the market entry of biosimilar competitors for Stelara until 2025. This is expected to ensure the drug’s continued significant contribution to the company’s overall sales.

Anticipated Challenges for Stelara

However, European sales of Stelara may face headwinds starting from mid-next year, following the expiration of a key patent. J&J’s Chief Financial Officer, Joseph Wolk, acknowledged the possibility of a slight impact.

Medical Device Sales

In contrast to the pharmaceutical division, J&J’s medical device unit reported sales of $7.46 billion, falling short of Wall Street estimates. Within this segment, the orthopedic business constituted approximately 29% of total medical device sales for the quarter.

Factors Influencing Device Sales

Demand for devices used in abdomen surgeries experienced a slowdown, attributed to the popularity of new weight-loss drugs like Novo Nordisk’s Wegovy and Ozempic, particularly among obese patients.

Future Prospects

Wolk expressed optimism that the use of such drugs may eventually lead patients towards procedures utilizing J&J products. While the company currently lacks scientific expertise in the obesity drug space, Wolk hinted that J&J remains open to opportunities for differentiated products in this area.

The restructuring of J&J’s orthopaedic business marks a strategic shift in the wake of a dip in medical device sales. With a renewed focus on core operations and an optimistic outlook in its pharmaceutical division, J&J is poised to navigate challenges and explore opportunities in the evolving healthcare landscape. The company’s ability to adapt and innovate will be crucial in achieving its ambitious drug sales target by 2025.