Finance

Japan’s Unexpected Recession Shifts Germany to World’s Third-Biggest Economy

Highlights

- Japan unexpectedly slips into recession, losing its status as the world’s third-largest economy to Germany.

- Weak demand from China, sluggish consumption, and production halts at Toyota Motor Corp contribute to Japan’s economic downturn.

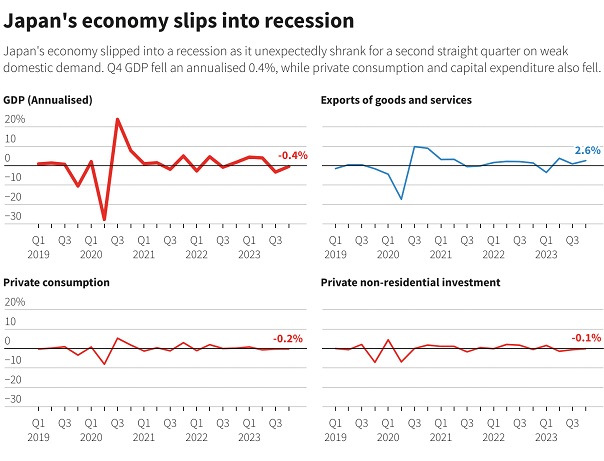

- Japan’s GDP fell by an annualized 0.4% in the October-December period, marking two consecutive quarters of contraction.

- Analysts cast doubt on the timing of the Bank of Japan (BOJ) exiting its ultra-loose monetary policy amid weak economic data.

- Economy minister emphasizes the need for solid wage growth to support consumption, which is lacking momentum due to rising prices.

- Yields on Japanese government bonds fall, and the Nikkei stock average rallies, reflecting market expectations of delayed BOJ policy shifts.

- Japan’s nominal GDP falls below Germany’s, ranking it as the world’s fourth-largest economy.

- Frail private consumption and capital expenditure contribute to Japan’s economic challenges.

- BOJ’s plans to end negative rates and overhaul monetary framework may face delays due to economic uncertainties.

- Some analysts remain optimistic about an early exit from ultra-loose policy, citing Japan’s tight labor market and robust corporate spending plans.

Japan’s unexpected slide into recession has garnered attention worldwide, particularly as it relinquishes its status as the world’s third-largest economy to Germany. The country’s economic downturn, marked by two consecutive quarters of GDP contraction, has raised concerns about the timing of the central bank’s departure from its long-standing ultra-loose monetary policy.

Analysts are pointing to various factors contributing to Japan’s economic challenges. Weak demand from China, sluggish consumption domestically, and production disruptions at a unit of Toyota Motor Corp have all played a role in hindering Japan’s path to recovery. Yoshiki Shinke, a senior executive economist at Dai-ichi Life Research Institute, highlighted the sluggishness in consumption and capital expenditure, which are crucial components of domestic demand.

The recent government data revealed that Japan’s gross domestic product (GDP) fell by an annualized 0.4% in the October-December period, following a 3.3% decline in the previous quarter. This unexpected contraction has put Japan in a technical recession, a concerning development for policymakers and economists alike.

Japan’s Recession Shifts Germany to Third in Global Economy

Despite initial expectations for the Bank of Japan (BOJ) to gradually phase out its massive monetary stimulus this year, the weak economic data may delay such plans. Analysts are now questioning the BOJ’s forecast that rising wages will drive consumption and sustain inflation around its 2% target. Stephan Angrick, a senior economist at Moody’s Analytics, noted the challenge this poses for the central bank in justifying a rate hike, let alone a series of hikes.

Economy minister Yoshitaka Shindo emphasized the importance of solid wage growth to support consumption, which he described as lacking momentum due to rising prices. The weak economic data has led some traders to push back expectations of an early BOJ policy shift, reflected in the decline in yields on Japanese government bonds and the rally in the Nikkei stock average.

With Japan’s nominal GDP falling below Germany’s, it has slipped to the position of the world’s fourth-largest economy. The weak economic data is attributed to frail private consumption and capital expenditure, both of which have contracted for the third consecutive quarter.

While the BOJ had been preparing to end negative rates by April and overhaul its monetary framework, the recent economic challenges may prompt a more cautious approach. With the U.S. Federal Reserve pausing after aggressive interest rate hikes, the BOJ is expected to proceed slowly with any policy tightening measures.

Despite the uncertainty surrounding Japan’s economic outlook, some analysts remain optimistic about the potential for an early exit from ultra-loose policy. Marcel Thieliant, head of Asia-Pacific at Capital Economics, maintains his projection that the BOJ will end its negative interest rate policy in April, citing Japan’s tight labor market and robust corporate spending plans.

In conclusion, Japan’s unexpected recession has raised significant concerns about its economic trajectory and the timing of the central bank’s policy adjustments. With lingering uncertainties both domestically and globally, policymakers face the challenge of navigating Japan’s economy through these turbulent times.