Business

Evergrande’s Liquidation Order: A Landmark Moment in China’s Crisis Hit Property Sector

Highlights

- Hong Kong court orders the liquidation of China Evergrande Group, the world’s most indebted property developer.

- Evergrande fails to present a workable restructuring plan, intensifying concerns in Chinese markets.

- Alvarez & Marsal were appointed as the liquidators to navigate the complex process.

- The decision raises uncertainty in China’s already fragile property and capital markets.

- Evergrande’s CEO assures continuity in home projects despite the liquidation order.

- Trading in Evergrande shares halted; subsidiaries seek resumption after the verdict.

- Ongoing investigations impact creditor expectations, lowering the initial recovery rate estimate.

- Evergrande’s $23 billion debt revamp plan involves a debt-for-equity swap with creditors.

- The ruling marks at least the fourth instance of a Chinese developer ordered to liquidate in Hong Kong since mid-2021.

- Investors closely monitor how Chinese courts handle foreign creditors in the wake of the Evergrande crisis.

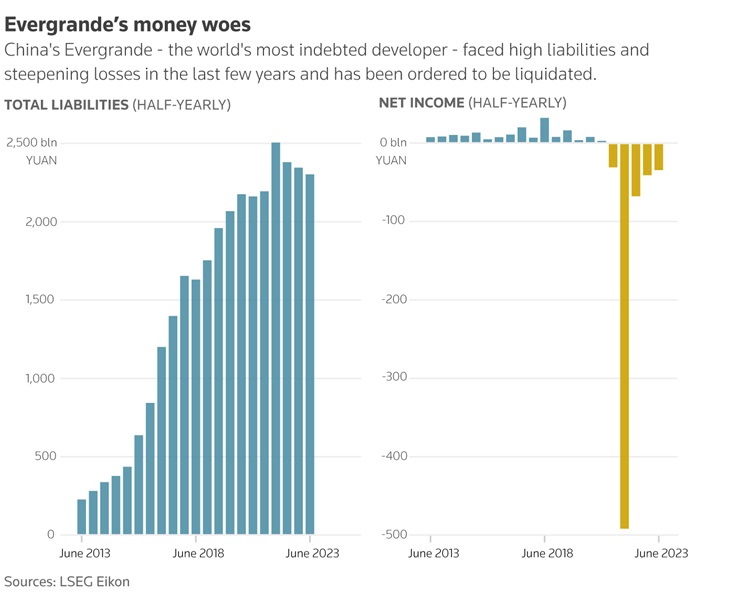

In a significant development, a Hong Kong court has ordered the liquidation of China Evergrande Group, a property giant grappling with over $300 billion in total liabilities. The decision, delivered by Justice Linda Chan, intensifies the challenges faced by China’s fragile property market and adds uncertainty to the country’s capital and property markets.

Evergrande’s Landmark Liquidation in China’s Property Crisis

Evergrande’s Landmark Liquidation in China’s Property Crisis

Key Insights: China Evergrande’s Landmark Liquidation Decision and Financial Landscape Impact

Concrete Restructuring Plan Absence

The court’s decision to liquidate Evergrande comes after the company failed to provide a concrete restructuring plan more than two years after defaulting on its offshore debt, according to Justice Linda Chan.

Economic Impact

The ruling is expected to further shake China’s already fragile property market and has the potential to jolt the country’s financial stability. Policymakers are increasing efforts to contain the deepening crisis.

Complicated Liquidation Process

The decision sets the stage for a prolonged and intricate liquidation process, with potential political considerations. Investors are keenly watching to see how Chinese courts will recognize Hong Kong’s ruling and how foreign creditors will be treated.

Appointment of Liquidator

Alvarez & Marsal has been appointed as the liquidator, a move deemed in the interests of all creditors. This appointment could involve developing a new restructuring plan for Evergrande, especially crucial as Chairman Hui Ka Yan is under investigation for suspected crimes.

Impact on Evergrande’s Business

Despite the liquidation order, Evergrande’s Chief Executive, Siu Shawn, assured that home-building projects would still be delivered. The ruling is not anticipated to affect the operations of Evergrande’s onshore and offshore units.

Market Response

Trading in Evergrande shares was halted, with a potential 20% drop before the hearing. Subsidiaries, including China Evergrande New Energy Vehicle Group and Evergrande Property Services, also had trading suspended.

Economic Challenges

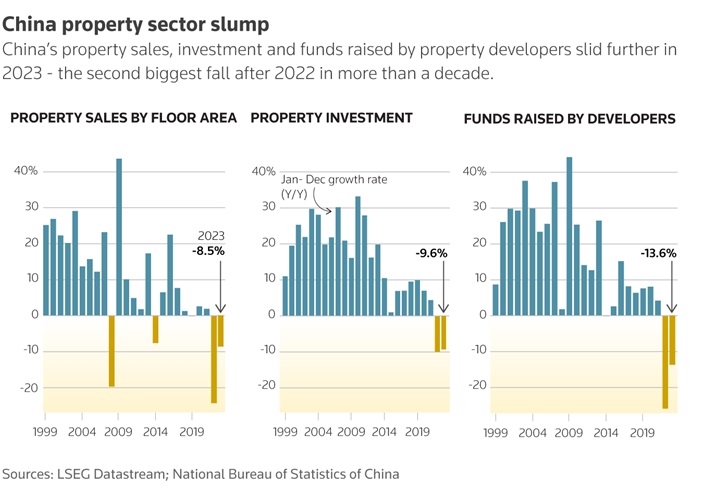

China is currently grappling with an underperforming economy, its worst property market in nine years, and a stock market near five-year lows. Any additional hit to investor confidence could further impede efforts to rejuvenate growth.

Debt Restructuring Attempts

Evergrande had been working on a $23 billion debt revamp plan with a group of creditors known as the ad hoc bondholder group for almost two years. The latest proposal involved creditors swapping debts for shares in Evergrande’s two Hong Kong units.

Offshore Assets

Evergrande’s key offshore assets include an unsecured interest-free loan, positions in the Greater Bay Area Homeland Investment, and a fund. The company could appeal the liquidation order, but the process will continue pending the appeal’s outcome.

Recovery Rate Concerns

Citing a Deloitte analysis, Evergrande had estimated a recovery rate of 3.4% if liquidated. However, with ongoing investigations into its flagship unit and chairman, creditors now anticipate a recovery rate of less than 3%.

Historical Context

This marks at least the fourth instance of a Chinese developer being ordered to liquidate by a Hong Kong court since the debt crisis unfolded in mid-2021.

The Evergrande liquidation order underscores the intricate challenges facing China’s property market and the efforts needed to navigate the evolving financial landscape.