Since the beginning of its activity, Access Bank Mozambique has promoted diversity and the inclusion of women in society and...

Mastercard introduces Scam Protect, leveraging AI to combat scams, partnering with organizations like Verizon and NatWest to enhance security. Collaborating with the Global Anti-Scam Alliance, Mastercard...

X, formerly Twitter, is launching a TV app to bring user-uploaded videos to living room screens, competing directly with YouTube. The X TV app promises a...

Mercedes introduces the G 580, an all-electric version of its iconic G-Class SUV, featuring impressive off-road capabilities and unique electric drivetrain technology. Despite market challenges and...

Mastercard’s new mobile virtual card app integrates seamlessly with digital wallets, offering secure and convenient contactless payments for businesses worldwide. The app provides robust spend controls,...

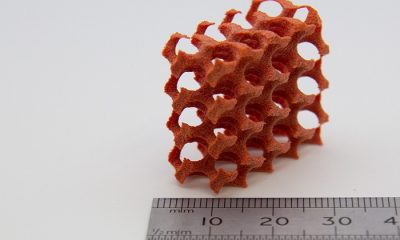

Researchers at the University of Nottingham have developed a new coating for plastic particles used in 3D printing, enhancing their functionality with color and anti-mould properties....

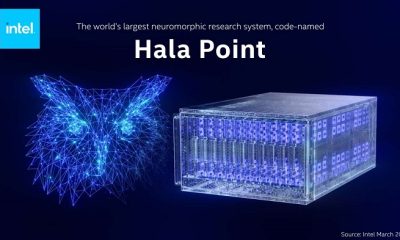

Intel unveils Hala Point, the world’s largest neuromorphic system, advancing brain-inspired AI research with unprecedented efficiency and scalability. Hala Point, powered by Intel’s Loihi 2 processor,...

adidas unveils range of footwear and apparel representing the passion that burns within each and every athlete competing on the global sporting stage The fire that...

QR4, a new cardiovascular risk prediction tool, developed using data from 16 million UK adults, outperforms current prediction tools, identifying previously missed high-risk patients. The QR4...

E PERFORMANCE hybrid drive with 600 kW (816 hp) system output Fastest acceleration of an AMG series model: from 0 to 100 km/h in just 2.8...

Nubank and Mastercard’s study in Brazil highlights the transition from financial access to usage, revealing prepaid cards as a gateway to advanced financial products. Active usage...